13, nov

Southern Area away from Ca Boy Charged in the step 1 forty-two Million Fraud Connected with Bitcoin Atm Places and you can Vast majority Gold Purchases; Prey is Retiree which Destroyed slot lucky twins Lifestyle Deals United states Agency from Fairness

Posts

New users will get 800,100000 CC and you may 100 percent free 40 South carolina for a discounted price away from 15.99, otherwise step one.2 million CC and you may free 60 Sc to own 23.99. Western Silver Eagles would be the official You bullion gold coins minted by the the united states Perfect since the 1986, created from 22 karat silver (91.67percent pure) with additional copper and you can silver for abrasion resistance. It hold legal-tender face values (fifty for example ounce), try secured from the Us authorities to have pounds and you will purity, and they are the only real 22K gold device IRA-qualified (some other IRA silver have to be 99.5percent pure). Eagles typically sell at the cuatro-6percent superior more place speed due to bodies backing, high recognition, and you may solid secondary industry exchangeability. Normal gold pubs (away from PAMP Suisse, Borrowing from the bank Suisse, etc.) is actually 24K absolute silver (99.9percent) that have down advanced (2-4percent more than place) however, lack regulators make certain.

- “For example, should your taxpayer given FTB a different target once they registered its 2021 income tax return, FTB could use you to definitely address to have reason for its MCTR payment,” a representative said.

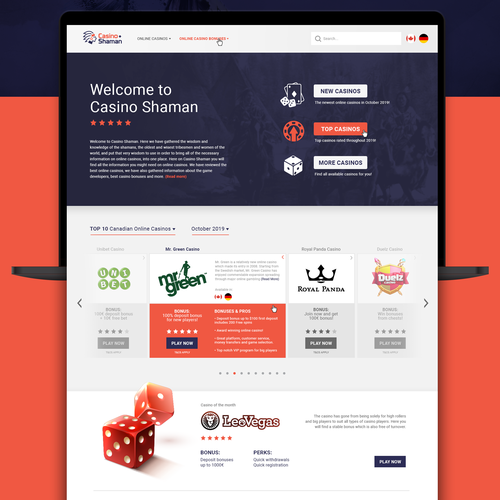

- Test the dining table on top to your market’s top no put local casino bonuses.

- Discover at least one head put (paycheck, pension fee, government work for percentage), which have deposits totaling 5,100 or even more.

- Pros were no papers walk for cash sales (in this courtroom restrictions), power to see points before you buy, and you will help local organizations.

- We looked for large production, lowest charges, realistic minimums and you may confident buyers enjoy.

- The new Marcus from the Goldman Sachs High-Yield On the web Family savings is a strong account for people who do not want charge, earn an appealing give or take benefit of 24/7 support service.

Having prices slower popular downward, it might be a little while up until loan providers start providing interest costs anywhere close to 7percent. Yes, high-yield discounts profile is actually secure while they usually is insurance coverage and you may security measures. The new FDIC and you may NCUA cover dumps from the insured institutions therefore customers don’t eliminate their funds in the eventuality of incapacity, with an elementary visibility limit from 250,000 per depositor. High-produce deals membership allow you to earn among the highest possible productivity and you can accessibility your hard earned money any moment. To maximize the go back, even if, you’ll have to implement several steps. You ought to set normally on the a high-give checking account since you conveniently can be, while maintaining enough money on the family savings to fund go out-to-go out expenditures.

A few of the laws and regulations you to protect rich savers’ bank dumps only changed. Some tips about what to learn: slot lucky twins

Otherwise, if your number you paid is over step three,one hundred thousand, you can also capture a credit facing your own tax for the year where you paid off they, any results in the least slot lucky twins taxation. If there is one or more items to help you report on line 8z, mount an announcement you to definitely listing for each product and go into the overall of the many private items in column B otherwise line C as the educated less than. California lotto winnings – California excludes Ca lotto winnings out of taxable earnings. Type in column B the level of California lotto payouts integrated regarding the federal amount on the web 8b, column A great. Enter in line B the level of county income tax refund registered inside line A good.

Chumba Casino – Rating Totally free SCs for 5

Refunds out of joint tax statements could be applied to the newest expenses of the taxpayer otherwise mate/RDP. After all taxation debts try paid, people kept credit was placed on expected voluntary contributions, or no, and the sleep might possibly be refunded. Make reference to your own finished government tax go back to over which part. On the most recent taxable seasons, the newest threshold number is 30 million. An excellent taxpayer can get choose to apply the new supply of accounting to possess long-term deals so you can contracts entered to the on the or immediately after January step 1, 2018.

This is because the credit isn’t area of the refund out of withholding or projected taxation repayments. A variety of Ca income tax credit are around for decrease your taxation for individuals who meet the requirements. To figure and claim really unique credits, you ought to complete another mode or agenda and you may mount it to your Form 540.

Your own sum tend to finance the acquisition of far-needed dinner to own delivery in order to dining banking companies, pantries, and soup kitchen areas on the state. The official Agency from Societal Characteristics usually monitor the delivery to make sure the food is made available to those very in need. Benefits will be accustomed offer offers to Ca scientists to investigation Alzheimer’s situation and you can associated problems. This study includes first science, prognosis, medication, protection, behavioral problems, and you may caregiving.

- Locating the best no-deposit bonus codes comes to particular detective work to make sure your’lso are delivering a reasonable offer.

- You’ll gain access to 15,000+ fee-100 percent free ATMs in the country and many financial, borrowing from the bank and you will paying features.

- If you are searching so you can refinance otherwise purchase a home inside the California using home financing, here are a few the self-help guide to financial rates and getting a home loan on the Golden Condition.

- Whenever one to really does arrive, there is certainly usually a capture, such as lowest limits to your earnings.

For the Friday, an unusual 20 twice eagle silver coin marketed for step 1.49 million, from the 70,100000 times their initial value. The fresh money is actually one of many issues dating back months of Ca Gold rush and you will prospectors up for bid during the Stack’s Bowers Galleries Rarities Nights Public auction in the Costa Mesa, Ca. The new unique function is the icon of just one’s game’s know themselves. Sure, it’s one to vegetarian sustain whom either provides incentive combinations to a good multiplier away from 5000. It’s such as delivering chased throughout the day on account of the newest a vengeful karaoke microphone, simply for they in order to quickly build available to choose from a good fruit in your mind.

Towns such Washington, Idaho, Michigan, although some do not let professionals to register and you may spin at the certain or all of the casinos on the internet. To register, only complete their details, or register as a result of social network including Twitter or Bing in order to disregard yourself typing your information. The brand new 20 no-deposit added bonus obtained from this offer is only available during the Borgata Online casino merely and can not be used on Jackpot Slots, Web based poker, or Sports. Very first, be sure your bank account in this 2 days to get 250,000 GC and you will 25 Sc. Next, log on just after everyday to own 30 successive months and you may have the additional three hundred,000 GC and you may 31 South carolina. You won’t need to make in initial deposit otherwise get into a LoneStar Local casino promo code in order to snag the brand new a hundred,00 GC, dos.5 South carolina acceptance bonus.

Times

We might as well as disallow the said exemptions, exclusions, credits, write-offs, or changes. For those who give incorrect information, you happen to be at the mercy of civil charges and unlawful prosecution. Noncompliance can increase their income tax responsibility otherwise reduce or lose one tax reimburse. For individuals who disregard to send your Setting(s) W-2 or other withholding variations with your taxation go back, do not send him or her on their own, or with various other backup of the taxation return. Mount the Forms W-2 and you may W-2G your acquired on the straight down top of your taxation come back. And, mount people Variations 1099, 592-B, and you can 593 demonstrating California income tax withheld.